Zero interest rate effects

The land of software and startups was more impacted than most realize

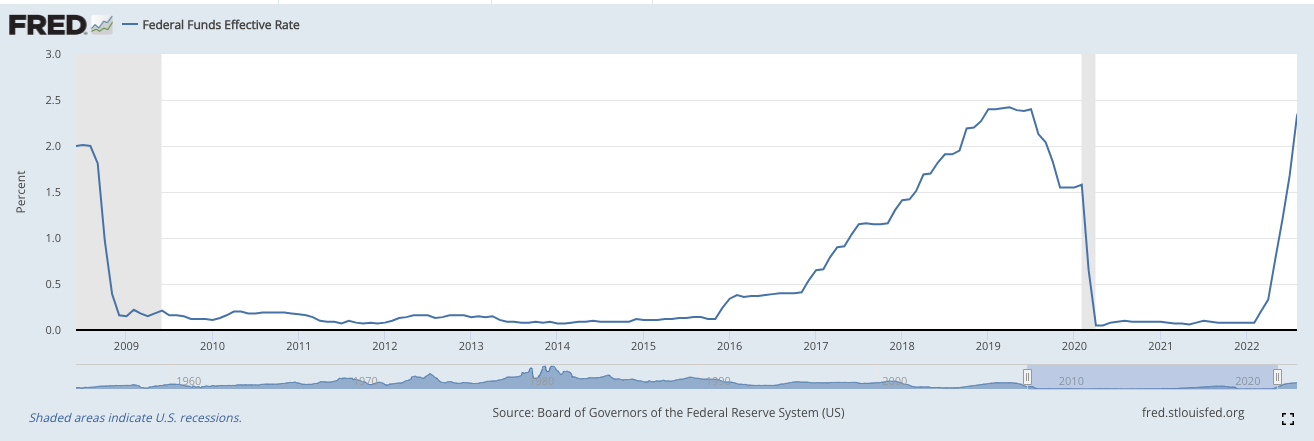

For seven straight years (2009 to 2016) and then again for another two (2020-2022), we experienced something unprecedented in capital markets: the US federal funds rate was at or near zero:

1955 to present:

Zooming in to 1991 to 2023:

And even further, let’s look at 2009 to 2023:

Source: https://fred.stlouisfed.org/series/FEDFUNDS

Desperation meets opportunity

Suddenly, capital was desperate for returns. And at the same time, the land of software engineering was entering a golden age of creation: AWS launched EC2 & S3 in 2006, Apple launched the App Store in July 2008 and Google followed with Android Market just one month later, and Facebook launched its ad platform in November of 2007.

Adding this all up: for the first time ever, it was possible to reach a massive audience with targeted advertising (Facebook), possible for a small team to build consumer applications that could get significant adoption (iOS, Android), and possible for that team to cheaply rent the servers needed to support those apps.

The result of these combined forces was a massive investment into software companies of all stages. It’s no surprise that Aileen Lee coined the term “unicorn startup” in 2013 - for the first time, many startups could achieve a billion-dollar valuation, as the venn diagram of large business opportunities and massive capital ready for investment became one large circle.

When money is free

Strange things happen when startups can easily raise massive amounts of money. A high valuation doesn’t necessarily equate to anything of substance - while there’s hopefully a business-to-be-had, many companies raised large rounds and got high valuations and produced nothing. Whatever they created and whatever its long-term worth, though, the incentives of our near-decade in a zero-interest-rate environment altered all sorts of behaviors.

Zero-interest-rate companies: Money first, questions later

It became possible to raise money on ideas. Companies didn’t need to prove usage, just show some logos of past employers and tell a good story. This changed the game for both who started companies and how they did so. It also changed the playing field - get money first, hire the team, then build. This is part of what drove the frenzied software hiring market over this time period.

Zero-interest-rate projects: Build it and see if they come

With free money, the limitation to growth was “can we build the thing, and how quickly” more than “is this the right thing to build”. If it wasn’t the right thing, there was usually more (free) money, and teams could just keep trying.

This is what I’ve started referring to as “zero-interest-rate projects”: start building something, and eventually figure out whether it solves anyone’s real problems. Since the money is free, building it is free.

Zero-interest-rate-hiring: Grow at all costs (b/c the cost is zero)

The real limitation to “can we build the thing” is “do we have the people to build the thing”. And so recruiting teams were built out to accommodate this need, interviewing processes were adjusted to move fast, and the whole industry had to keep up.

Zero-interest-rate-managers: Keep people happy to keep growing

As an engineering manager (and possibly any manager) when money is free, the ask is simple: grow the team. A manager who grows their team gets to keep growing, because they’ve demonstrated success in the only-thing-that-matters (more people to do the infinite work enabled by the infinite money). The worst thing that can happen for such a manager is someone leaving: that’s one more role that needs to be filled. The result is managers who aim to just keep everyone happy, regardless of ability or effort from those people, because it’s better to hit the hiring target than to spend time on performance management.

We’ve learned all the wrong habits

All of the above deserves a deeper analysis, but the most important point is the impact that a decade can have on an industry: every engineer who started or had their formative years, everyone who became a manager during this time, every leader thinking about how to staff projects, every product manager who didn’t learn how to do actual customer research and validation - all of these people are now the senior folk in the industry, and they spent a decade learning a way of working that only makes sense in a zero-interest-rate world.

I don’t know how we break out of this, and I don’t know the long-term consequences to our industry. But I do know that I see it every day: projects greenlit without clear customer need, managers trying to keep people happy rather than give them the tough feedback they need to grow, hiring practices built out of a time where competition for talent was at an all-time-high.

We need to all wake up and revisit our fundamental assumptions. It’s no longer a zero-interest-rate world.